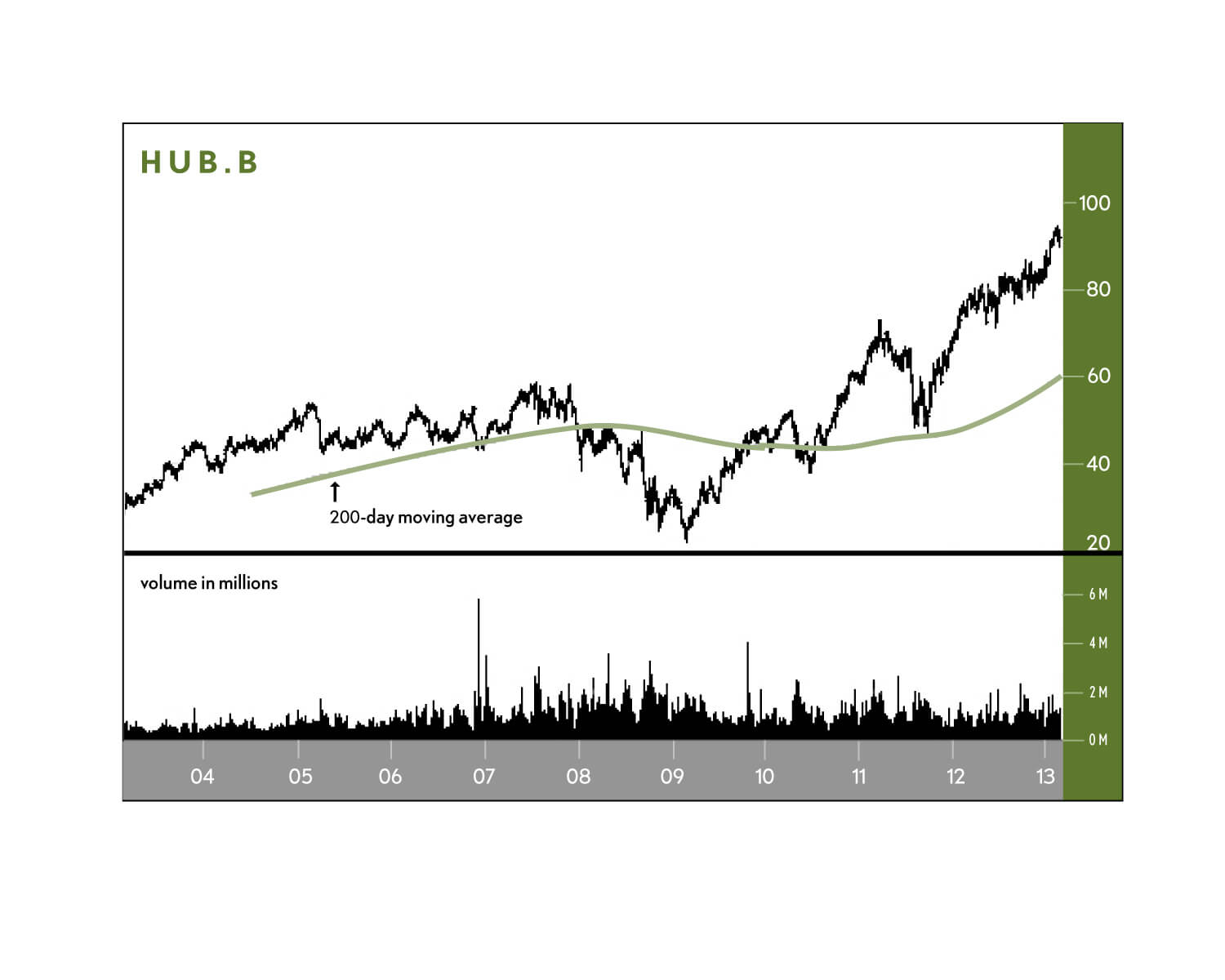

Hubbell is a high-quality company with a clean balance sheet; its revenues quickly resumed growing after the financial crisis, and it continues to carry little debt. With foreign sales making up less than 30% of Hubbell’s revenues, it still has a good amount of room to grow, particularly in the developing world. Like many other industrial companies, Hubbell expects revenues to improve as the U.S. and world slowly make their way out of the current slump. “Slowly,” however, is the key word. In its most recent earnings report, the company tempered expectations of great growth in the next year or two given the absence of a dramatic uptick in most types of construction or manufacturing. To demonstrate confidence in its own prospects, however, Hubbell did raise its dividend 10% at the end of 2012, to almost 2%. The stock has clearly sparked the interest of investors, gaining more than 50% in value the past year and a half. The stock’s voltage since the beginning of 2013 puts it at the top of our value buying range, but with any sort of momentary pullback, it is a good buy for the long run.

Corporate Responsibility

In recent years Hubbell has improved its awareness of corporate responsibility. Via the Hubbell Sustainability Initiative, the company tackles this goal both at home and for its customers. Hubbell’s modernized electric wiring systems improve energy efficiency in buildings and manufacturing facilities. The company offers LED fixtures and a variety of electric devices to smartly control electric use in buildings. Hubbell has also announced new projects to bring the business itself more in line with social responsibility. The company touts that it is the only lighting manufacturer with a LEED Silver-certified headquarters. It is also working on reducing packaging, using biodegradable materials, and implementing a recycling program for defective returns and scrap. Hubbell’s board and its senior management team each include one woman.

Revenues: $3.04 Billion

EPS:

2014E $5.98

2013E $5.50

2012A $4.99

Projected Annual Growth Rate: 11%

Dividend: $2.1%

52-Week High–Low: $94.70–71.35

Risk: Medium

Website: hubbell.com