Its goal is that by 2020, 100% will be sourced sustainably, along with halving the environmental footprint of its products. Unilever has also committed to halving the GHG impact of our products across the lifecycle by 2020. In November 2014, UN’s European food business reached 100% traceable and certified sustainable palm oil, representing 58% of the company’s global volume. UN also intends to help more than one billion people improve their health and well-being, through e.g., Lifebuoy’s drive to promote hygiene through hand-washing with soap.

Under Paul Polman, Unilever stopped delivering quarterly guidance reports to investors. “It has allowed us to focus instead on a mature discussion with the market about our long-term strategy,” he told the Harvard Business Review in 2012.

Forty-two (42) percent of Unilever’s managers are women. The company has been recognized for its efforts in making gender equality a business priority by committing to transform its workplace culture. These efforts extend to how the company markets its products to women. For example in 2004, Dove launched its Campaign for Real Beauty to challenge beauty stereotypes, provoke discussion, and encourage debate.

Unilever’s shift toward emerging markets was ahead of many of its competitors, and it has placed the company in a strong competitive position. In developed markets, the company’s sales are basically stagnant, so Unilever is working to reduce costs and improve its profit margins company-wide. As part of its ongoing strategic review, the company has been shifting away from food and toward personal care and home care products. A key part of the company’s strategy is to grow faster than its markets and to improve its profitability.

UN appears quite attractive relative to key peers, with high returns on invested capital and the lowest valuation, particularly on a price/sales basis. Unilever is well managed, and the stock offers an above-average dividend yield of almost 4% and moderate long-term growth prospects. We like this company for its steady dividend, strong sustainability record, and the fact that it is actively exploring certified B Corp status.

Unilever N.V

Revenues: $69 billion

Market Capitalization: $119.4 billion

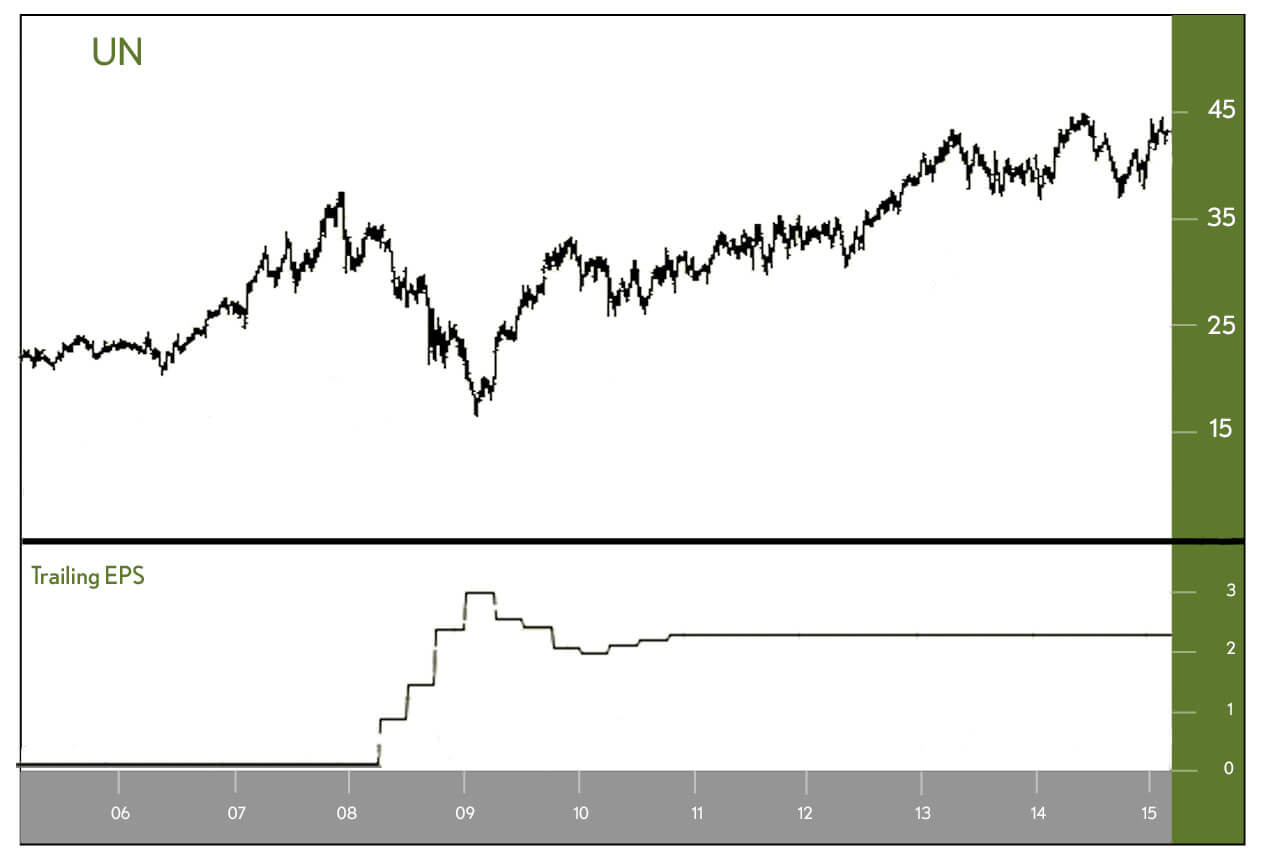

Earnings Per Share (EPS):

2014 est. $1.99

2015 est. $2.20

Projected 3–5 Year Annual Earnings Growth: 9%

Dividend Yield: 3.31%

Stock 52-week Low–High: $36.78–44.41

Risk: Below Average

Website: http://www.unilever.co.uk/